Decentralized data infrastructure

for Privacy, trusted collaboration and effective AI

Decentralized data infrastructure

for Privacy, trusted collaboration and effective AI

Our mission

CodeGreen builds digital infrastructure to enable collaborative solutions to global challenges. Entrusted by the UN, governmental bodies, and the private sector, we engineer decentralized systems that enable data sovereignty and privacy, while ensuring immutable trust, security, and stability. While our initial efforts focus on facilitating collaborative action on climate, our core technologies have been designed to bridge the digital divide and foster a level playing field to advance global prosperity.

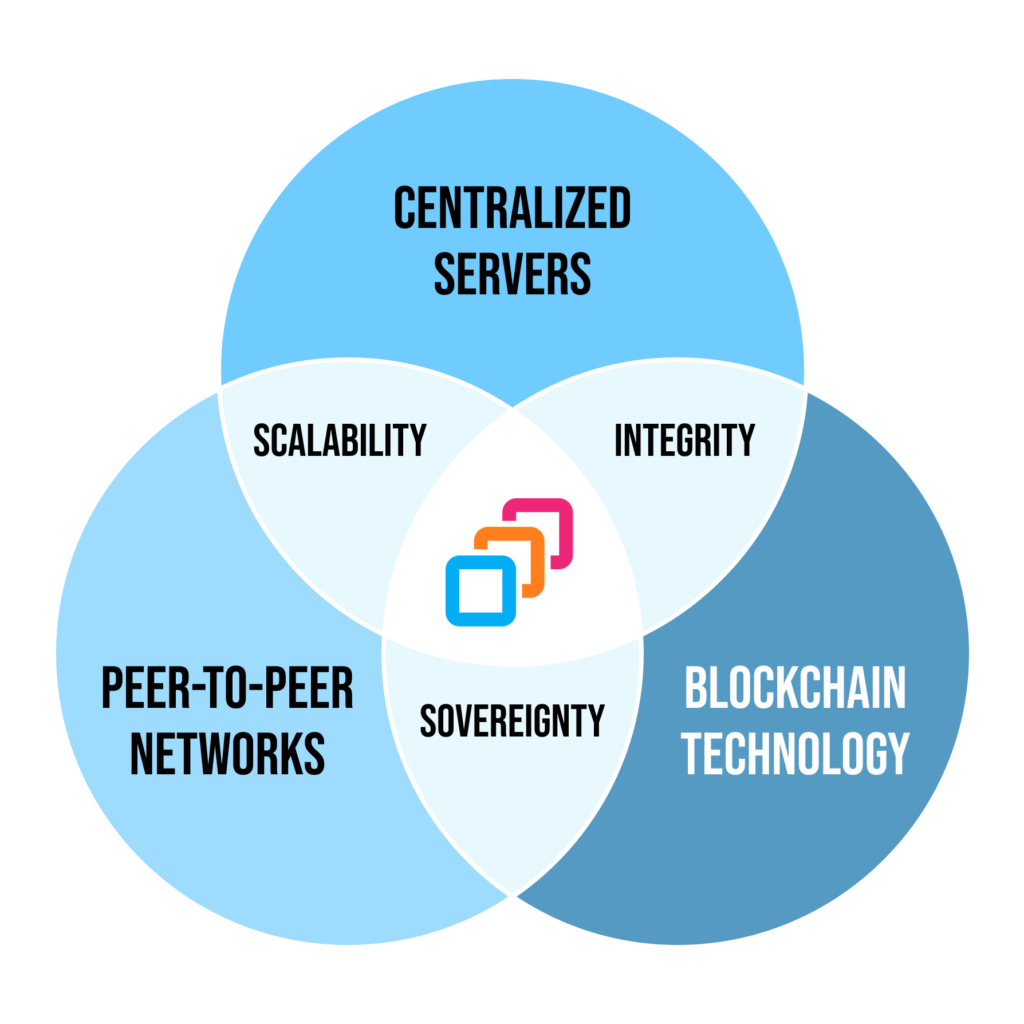

Codegreen’s Technology Solves the data trilemma To facilitate trusted collaboration

Provable Records, Accuracy & Auditability

Immutable trust enables efficient collaboration in mission critical settings by holding all parties accountable to each other and to authorities.

Selective Sharing & Permissioning

Fine-grained access control functionality increases willingness to collaborate by protecting sensitive information and business edge.

Regulatory Compliance

Decentralized KYC and data sovereignty align with the EU GDPR and proactively achieve the widespread intentions of international regulators.

Inclusivity & Equity

Decreasing the reliance on centralized parties encourages inclusive participation and distributes generated value more evenly.

Founding Team

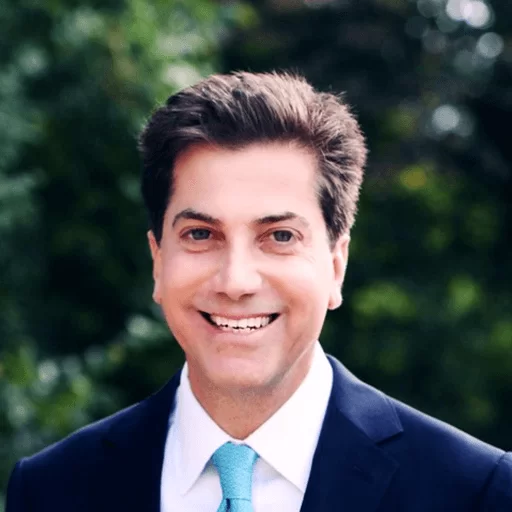

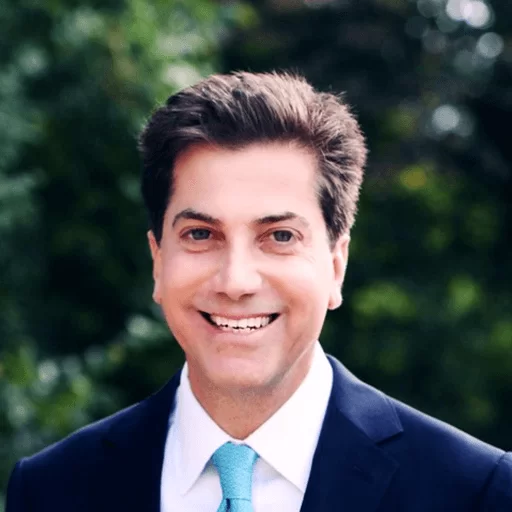

Neil Cohn

Co-Founder & CEO

Neil is a blockchain and sustainable finance expert who was instrumental in developing the early markets for carbon and renewable energy. Neil’s recent innovations have been collaborations with the World Bank, Costa Rica, and the IFC on foundational infrastructures for climate finance, with a goal of accelerating the transition to a more equitable global economy.

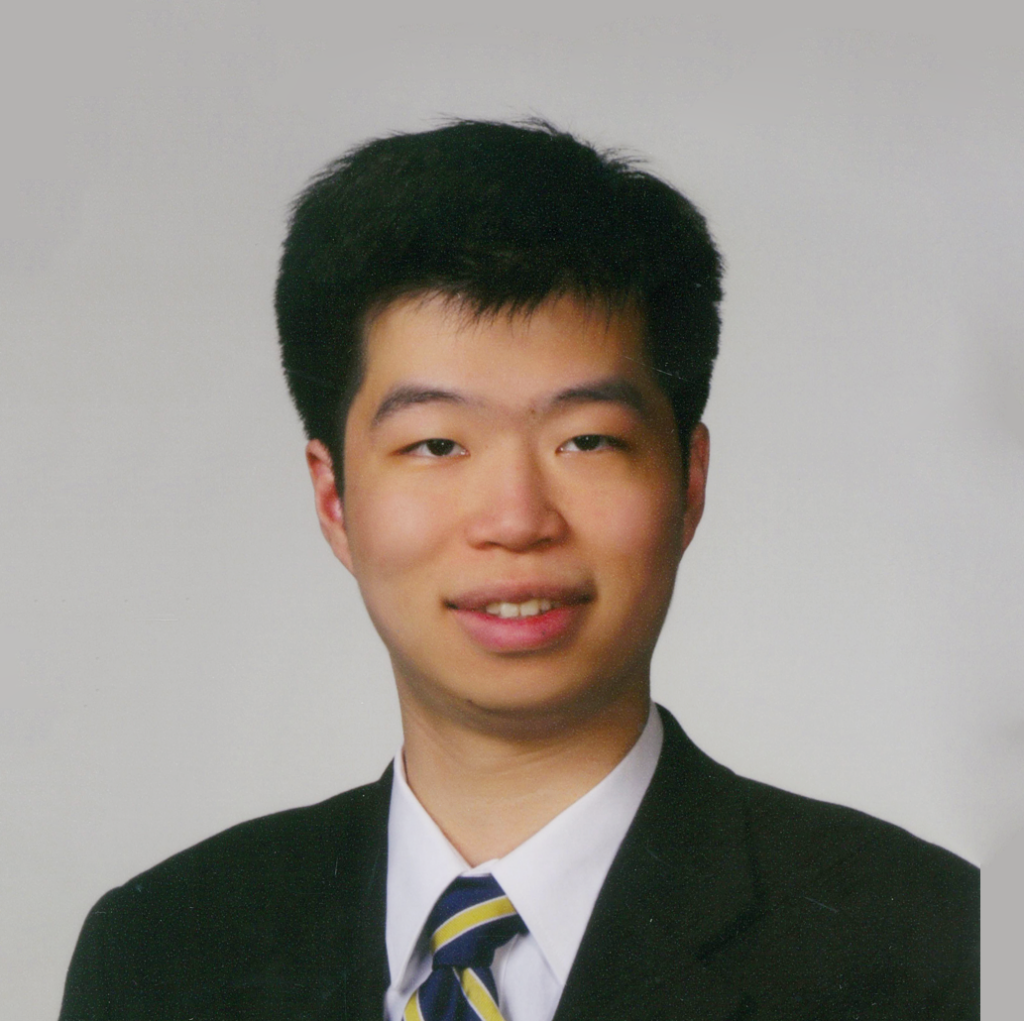

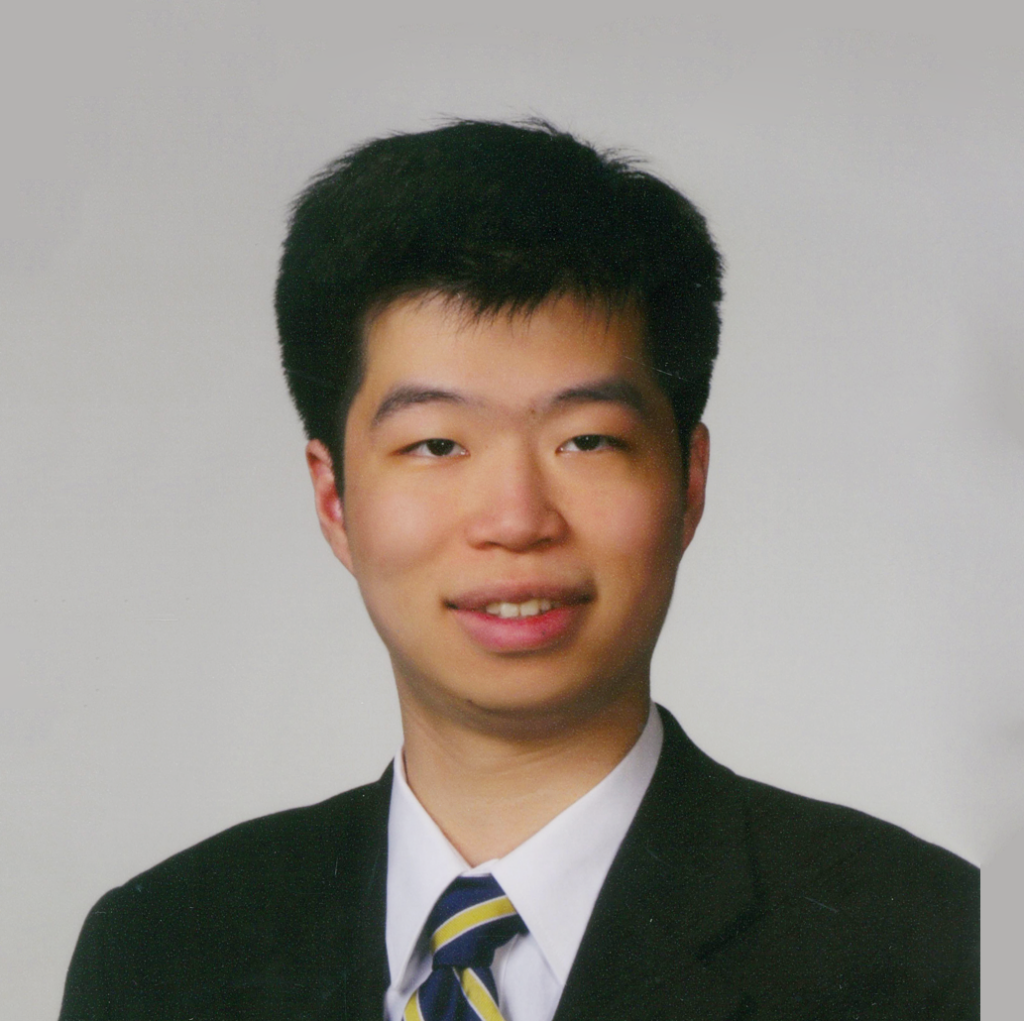

Schrasing Tong

Co-Founder & CTO

Schrasing is a member of the Decentralized Information Group at MIT. He is an experienced solution architect who possesses deep technical expertise in blockchain technology, AI/ML, and industrial-grade software systems. Schrasing played a pivotal role in designing core systems for tokenized carbon asset lifecycles for the World Bank.

Neil Cohn

Co-Founder & CEO

Neil is a blockchain and sustainable finance expert who was instrumental in developing the early markets for carbon and renewable energy. Neil’s recent innovations have been collaborations with the World Bank, Costa Rica, and the IFC on foundational infrastructures for climate finance, with a goal of accelerating the transition to a more equitable global economy.

Schrasing Tong

Co-Founder & CTO

Schrasing is a member of the Decentralized Information Group at MIT. He is an experienced solution architect who possesses deep technical expertise in blockchain technology, AI/ML, and industrial-grade software systems. Schrasing played a pivotal role in designing core systems for tokenized carbon asset lifecycles for the World Bank.

WHO WE WORK WITH